July 29, 2015 at 06:10PM

- By mid-afternoon Tuesday, FCX’s stock price was up 9.9% on announcements of cost reductions, and the firm was ranked among the most heavily traded bond issuers on Monday.

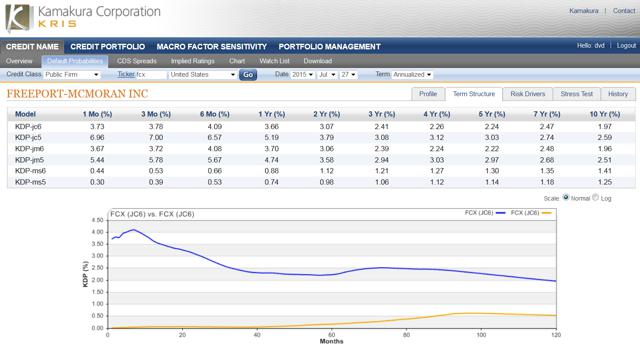

- We use modern default probabilities and credit spreads to assess FCX. We find the firm is in the riskiest 20% of its peers from a default perspective.

- That doesn’t necessarily mean that the bonds are not good value. When we do our normal “best value” rankings, however, all 4 heavily traded FCX bonds offer below-average value.

from Jru RSS http://ift.tt/1eBmjXP